|

Xealth Organization | Under the Radar Disruptors

September 22, 2021

|

|

|

|

|

Together with

|

|

|

|

“‘Middle children’ that successfully overcome these challenges will displace traditional incumbents, and even digital health startups, in healthcare’s current world order.”

|

|

Rock Health’s latest blog post on under the radar healthcare disruptors.

|

|

|

|

The booming digital health sector has seen such rapid expansion that it is beginning to enter the next level of its industry life cycle: the stage where solutions have solutions.

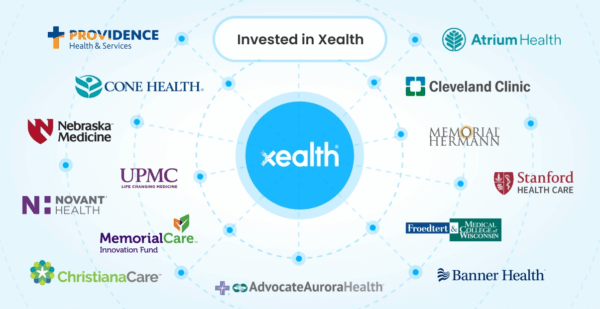

Digital health integration platform Xealth recently closed $24m in Series B funding, bringing the Providence St. Joseph Health spinoff’s total funding to $52.6m.

Xealth aggregates and organizes digital health tools within the EHR, enabling not only easier reporting, but also centralized distribution, enrollment, and patient monitoring.

The Xealth platform has three interdependent modules:

- Xealth Clinical Interface – Solutions are ordered, delivered, and tracked from within the EHR, with clinical decision support matching patients to relevant solutions.

- Xealth Digital Command Center – Provides customized reporting of patient and provider engagement, which is aggregated to match demographics to solutions.

- Xealth Integration Layer – Supports deployment of multiple solutions through a single integration with the EHR, allowing health systems to save IT resources by avoiding independent vendor integration.

The Takeaway

As health systems pursue innovation, they’re presented with an abundance of disjointed products with specialized use cases, creating the need for a platform that allows physicians to prescribe and monitor these solutions within a single cohesive workflow.

Xealth’s services are already available to over 100k physicians, and the company states that care teams are seeing improved patient engagement metrics as a result of measuring outcomes across a health system’s entire virtual solution ecosystem.

Aggregators that improve usability of existing solutions have emerged as success stories in other industries such as business collaboration software, and Xealth is looking to replicate this success within the digital health landscape.

|

|

|

|

Image Credit: Rock Health |

|

|

Digital health venture fund and advisory team Rock Health recently published an excellent blog post outlining what they call healthcare’s “middle children,” defined as large-but-not-huge companies that should be eyeing expansion into healthcare.

The authors argue that these middle children have distinct competitive advantages over the cohort of technology giants that have recently been pursuing the healthcare space, which include the likes of Amazon, Alphabet, and Apple.

- Middle children with market capitalizations between $10b and $350b are large enough to make an impact in healthcare, but small enough to avoid the scrutiny of massive players. They are often consumer-facing, with business lines that could pivot towards a healthcare use case (picture Lululemon’s acquisition of Mirror).

- Larger middle children have deep pockets and talents pools (Salesforce, Nike), with the capabilities to pursue large healthcare goals.

- Smaller middle children have more specialized capabilities (Garmin, Airbnb), that could help with solving more focused problems.

Middle Children Advantages

- Smaller healthcare goals are big enough for middle children to pursue for growth, whereas much larger companies need loftier projects to warrant market expansion.

- Loyal customer bases can be activated by middle children to establish initial users while avoiding the regulatory attention quickly drawn by larger competitors.

- Specialized assets from middle children, such as logistics expertise or data analytics, can provide a competitive edge in healthcare.

Potential Middle Children Plays

- Blizzard could passively monitor behavioral health conditions for children playing its games

- Paypal could integrate Health Savings Accounts to help users manage healthcare spending

- Hello Fresh could offer health insights and recommend food products for delivery

The Takeaway

Gaining share within the $3.5t US healthcare market is a powerful motivator for any company looking to pursue a strategy shift, but even consumer-favorite brands will need humility to navigate the complex and quickly evolving environment.

Although middle children don’t specialize in the sector, Rock Health makes a solid case that they might be some of the best-positioned companies for healthcare disruption, and I wouldn’t be surprised if we’re reading about some of the plays listed in this blog post in next year’s business news.

|

|

|

Explore Nuance’s Personalized Patient Experience

Personalized digital experiences drive better outcomes for patients and providers. Explore how Nuance is using AI automation to advance the quality of service across the care journey here.

|

|

- Health Cloud 2.0: Salesforce recently rolled out its latest suite of tools designed to help businesses navigate a post-pandemic work environment. Dubbed Health Cloud 2.0, the new solutions include: 1) “Dreampass” for in-person event safety with registration management and vaccine verification 2) Contact tracing for organizations 3) Vaccine management to deploy company-wide vaccination programs 4) Value-based care from anywhere to enable “organizations to personalize patient experiences.” Although each of these services are individually available through separate vendors, Salesforce’s cohesive package and strong brand image among employers give Health Cloud 2.0 great “new normal” positioning.

- Telehealth Usage: The AMA’s recent Physician Practice Benchmark Survey found that 70.3% of physicians worked in practices using telehealth services as of September 2020, but that usage varied widely by specialty. Telehealth was commonly preferred for consultations by dermatologists (87.3%), psychiatrists (85.8%), pediatricians (82.9%), while lower utilization was recorded for ophthalmologists (56.3%) and radiologists (37.2%). The technology also spanned across a wide range of use cases, such as managing chronic diseases (59.2%), diagnosing or treating patients (58%), and providing care for those with an acute disease (50.4%).

- Apple Data Sharing: Following Monday’s launch of iOS 15, iPhone users now have the ability to share data from their Health app directly with their doctors through their EHR (only available for Allscripts, athenahealth, Cerner, CPSI, DrChrono, Meditech Expanse). Those that enable the feature will allow visibility to data such as heart rate, hours of sleep, and time spent exercising, with future updates planned to enable proof of vaccination cards. The feature is designed to improve communication around biometric data while creating a more longitudinal picture of patient health.

- Staffing Shortage: Nomad Health recently raised $63m ($100m total funding) to expand its digital marketplace for temporary healthcare jobs amid an industry-wide labor shortage. Since the beginning of the pandemic, transactions in Nomad’s marketplace have grown seven-fold, and yet the healthcare staffing sector has seen a relatively low amount of new capital given the surging demand. Nomad will use the funding to help fill the supply gap for healthcare workers by expanding its online platform for transparent and flexible hires.

- Patients on AI: A new Mayo Clinic paper provided some much-needed insights into patients’ opinions and concerns about healthcare AI. Their analysis of fifteen focus groups (87 participants, 2019-2020) revealed that patients are generally optimistic about healthcare AI, particularly if there’s proactive oversight from clinicians to avoid any AI-based harm to them or their loved ones. The participants also believed that patients should be able to choose whether AI is involved in their care, and were concerned about AI’s cost impact, potential for bias, data security, and vulnerability to IT crashes.

- Hinge Physical Therapy: Online musculoskeletal clinic Hinge Health recently acquired wrnch, a computer vision platform that measures human motion. Hinge Health now has “the largest computer vision team in digital health,” and will use wrnch’s 3D motion tracking to augment its virtual physical therapy services with patient feedback and adjustments. If you’re a regular Digital Health Wire reader and this sounds familiar, this news arrives within the same week of IncludeHealth and Google’s co-developed MSK-OS platform rolling out to ProMedica Health System targeting similar remote physical therapy patients.

- More Second Opinions: The Clinic has been busy. Just one week after the Cleveland Clinic / Amwell joint venture announced that it was working with Anthem on providing virtual second opinions to members, it signed a similar deal with telehealth company ReviveHealth. Members of ReviveHealth now have access to second opinions from Cleveland Clinic for more than 550 specialties, powered by Amwell’s digital platform. According to The Clinic, second opinions are expected to be a $7b market by 2024 (up from $2.7b in 2019), with 28% of life-altering diagnoses changed after receiving a second opinion.

- Reducing Length of Stay: A new metastudy of 19 systematic reviews published in JAMA Network Open investigated which hospital interventions were associated with reducing length of stay for high-risk populations. Researchers found that for patients with heart failure, the most effective interventions were clinical pathways (mean reduction of 1.89 days) and case management (mean reduction of 1.28 days). The study found inconsistent results across other interventions such as discharge planning and medication management, highlighting an evidence gap for widely used programs and a need for further research.

- Alpha Series B: Women’s virtual primary care provider Alpha Medical recently raised $24m in Series B funding ($35m total funding) to develop its platform that allows women to easily access services for reproductive health, mental health, and primary care. Femtech has seemed unstoppable in recent weeks, with Tia, Maven Clinic, and Flo all making significant moves. Alpha Medical is aiming to stand out in the market by positioning its platform as the most convenient and accessible option.

- Rural Telehealth: For the 15% of Americans living in rural communities, a lack of telehealth access has widened healthcare disparities during the pandemic, prompting the HHS to allot over $19m to improving telemedicine in frontier and underserved communities. The funds will help update technology and train doctors on how to conduct virtual appointments in 11 states.The University of Mississippi was one of the largest beneficiaries, receiving $3.5m to aid medically underserved areas with widespread chronic disease and poverty.

|

|

|

|

|