|

CB Insights Digital Health 150 | Apple v AliveCor

December 8, 2022

|

|

|

|

|

Together with

|

|

|

|

“The goal is to identify high-risk patients and then bubble-wrap them. How do we keep you out of the hospital?”

|

|

Dr. Bill Wulf on his experience supporting JP Morgan’s healthcare strategy.

|

|

|

|

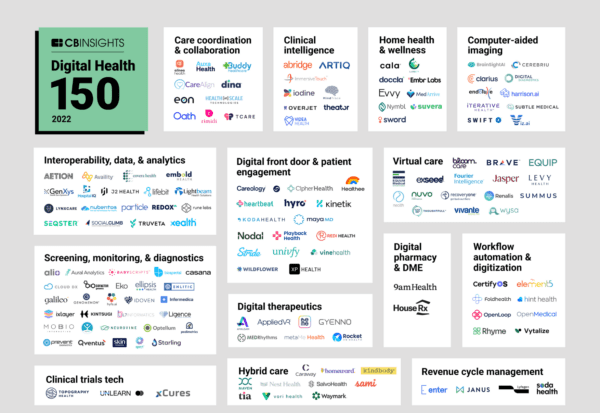

CB Insights released its annual Digital Health 150 rankings of the most promising private digital health startups, and it was interesting to see how dramatically the landscape evolved over the past year.

Methodology (maybe more of a Disclaimer): The startups that made the final cut were selected from a pool of 13k applicants based on “proprietary Mosaic scores,” company business models, funding, investor profiles, competitive positioning, tech novelty, and plenty of other metrics. Getting your company to purchase CB Insights’ data products wasn’t listed as one of them, although it probably wouldn’t hurt your chances.

With that out of the way, let’s dive into some of the biggest trends that emerged in the Digital Health 150 pictured above (here’s a high-res version).

- Early-stage innovation: This year’s Digital Health 150 included a huge share of high flying up-and-comers, with nearly half of the list at Series A or earlier in their growth. These players included Equum Medical (acute care telehealth), Vori Health (hybrid MSK treatment), Playback Health (mixed media patient-provider communications), and Homeward (rural healthcare provider).

- Diagnostics focus: The screening, monitoring, & diagnostics category led with 29 startups (25%), including Babyscripts (virtual maternity care), Ixlayer (precision health testing), and Enlitic (medical imaging AI). That category was followed by interoperability & data (12%), virtual care (11%), and patient engagement (11%). These categories clearly have a ton of momentum, but growing success leads to growing saturation.

- Mental health momentum: Although the treatment indications took some time to sort out manually, we counted 24 startups building mental health solutions, a big step up from the 10 that were included last year. It would have been more surprising if it were any other area.

- Few repeat showings: Around 90% of this year’s cohort wasn’t on last year’s list, which was apparently due to record M&A activity and public exits in 2021. Repeat showings included names that are tough to argue with like Xealth, Redox, and Maven Clinic.

- Top investors: General Catalyst was the most active investor in this year’s cohort, backing 13 of the companies since 2017 (Ex. Equip, Casana, SWORD Health). Insight Partners was a close second (10), followed by 7wire (6), and Plug and Play (6).

The Takeaway

Lists like these usually get some pushback because of the methodology or glaring company exclusions, but this year’s Digital Health 150 cohort feels pretty well aligned with the high momentum names that keep popping up in our own coverage. For what it’s worth, here were some of social media’s most commonly mentioned exclusions: Ada Health, Awell, Cityblock, Innovaccer, Memora, Ribbon, Turquoise, TytoCare, and Zus.

|

|

|

The New Standard for Prescription Safety

Synapse Medicine’s quick-deploy Prescription Assistance API and components can be up and running in less than a day and instantly connect your HCPs to real-time drug data and prescribing support. Find out how easy it can be to equip your providers with the tools they need to ensure prescription safety and precision for their patients.

|

|

The Power of the connectRN Platform

Learn how connectRN, the leading nurse-community, delivers high quality nurses and CNAs at consistent rates, and alleviates staffing shortages across healthcare settings.

|

|

- Apple v. AliveCor: Next week is the deadline for the International Trade Commission to ban imports of the Apple Watch following AliveCor’s successful patent-infringement lawsuit, which of course means that Apple’s been hard at work making sure that no such ban takes place. On Tuesday, the US Patent Trial and Appeal Board ruled that three AliveCor patents covering ECG tech were unpatentable because they were “obvious in light of previous advances,” and as you might imagine Apple plans to swiftly submit the new ruling to the ITC. AliveCor stated that it “strongly disagrees” with the decision, so it’s looking like the import ban will have to wait until after another round of appeals.

- Airpods as Hearing Aids: On a more rosy note for Apple, a new clinical trial found that AirPods Pro have the potential to serve as a hearing aid for adults with mild-to-moderate hearing loss, potentially representing a $169 alternative to $1,000+ devices. Taiwan-based researchers compared the AirPods Pro to traditional hearing aids with 21 participants, finding that the AirPods Pro’s “live listen” feature meets four out of five of standards for personal sound amplification products, and performs comparably to hearing aids with speech recognition in quiet environments.

- New 2023 CPT Codes: It’s that time of year again, and new CPT codes have officially been announced for 2023. Remote therapeutic monitoring codes were expanded to include codes for the first 20 minutes of treatment management services (98980) and each additional 20 minutes thereafter (98981). Digital ophthalmology received support for remote treatment of amblyopia using an eye-tracking device, as well as technical support, interpretation, and reporting (0704T–0706T). The last codes related to the digitization of glass microscope slides, enabling remote examination by the pathologist or supporting the use of AI (0751T–0763T).

- Depression Among Employees: A new Wysa report revealed that 40% of employees suffer from severe anxiety or depression, and often misrepresent their mental health struggles as physical illness to work through them at home (25.6%). The survey of 1k American workers also found that employees prefer the anonymity of seeking treatment via mental health apps over talking about their condition to HR (74% vs. 26%), their manager (59 vs. 41%), or a physician (68% vs. 32%).

- Advocate Health Merger: Advocate Aurora Health and Atrium Health completed their merger to create one of the largest nonprofit health systems in the US, spanning 67 hospitals with $27B in combined revenue. The new system, Advocate Health, now operates over 1,000 sites of care and expects to see nearly 6M patients annually, with Atrium’s CEO Eugene Woods slated to take over at the helm following an 18 month transition period.

- Wesper Sleep Health Funding: Wesper secured $9.6M in Series A funding to expand its partnerships with sleep centers across the US following the FDA clearance of its connected home sleep lab. Wesper’s wireless biometric sensors and algorithms allow for at-home diagnosis and remote treatment of conditions ranging from restless leg syndrome to sleep apnea.

- Usual Source of Care: A Primary Care Collective report found that a declining number of Americans have a “usual source of care”, dropping from 84% in 2000 to just 74% in 2019. Over the 20 year study period, the number of people saying a facility was their usual source of care increased by 18%, while the number of people citing clinician as their usual source of care decreased by 43%.

- Medical Informatics Series B: Medical Informatics secured $17M in Series B funding plus another $10M in debt financing to grow its product specialist and client engagement teams. The company’s 510(k)-cleared Sickbay SaaS platform collects real-time monitoring from patient bedsides, providing hospitals with real-time waveform data from bedside devices to enable remote monitoring.

- Medical Jargon Confusion: A JAMA study revealed not-too-surprisingly that medical jargon confuses patients, frequently resulting in them taking away a meaning that’s the exact opposite of what was intended. Although 96% of the 215 respondents knew that having a negative cancer screening meant they did not have cancer, only 67% knew that “positive nodes” meant that the cancer had spread. The top phrases to avoid were “grossly intact” for a good neuro exam or “impressive results” when something turns up on an X-ray.

- Ardent & BioIntelliSense: Ardent Health Services is collaborating with BioIntelliSense to roll out wearables for continuous inpatient monitoring across Ardent’s 30 hospitals. The partnership utilizes BioIntelliSense’s BioButton wearable device and BioCloud analytics engine to automate the collection of inpatient vitals and provide clinicians with more information to help proactive decision making.

|

|

Bedside MRI’s Patient Acuity Impact

With rising patient acuity rates creating “unsustainable financial challenges,” health systems are looking for innovative ways to increase critical care throughput. A growing number of health systems are achieving this goal with the Hyperfine Swoop point-of-care MRI, which can eliminate risks associated with intrahospital transport and keeps more critical care team members in the ICU.

|

|

What is Patient Engagement for a CMIO?

In its patient engagement guide for hospital execs, Nuance examines the goals and challenges of Chief Medical Information Officers, highlighting the ways that AI-powered patient engagement solutions can help CMIOs reduce physician burnout and improve care delivery.

|

|

Effortlessly Manage Your Provider Credentialing

Medallion’s all-in-one platform streamlines the management of your provider network – from licensing to credentialing to monitoring. Find out how Medallion can help you expand into new markets faster, automate administration, and effortlessly manage your provider data.

|

|

|

Share Digital Health Wire

|

|

Spread the news & help us grow ⚡

|

|

Refer colleagues with your unique link and earn rewards.

|

|

|

|

|

Or copy and share your custom referral link: *|SHAREURL|*

|

|

You currently have *|REFERRALS|* referrals.

|

|

|

|

|