|

Mass General Home Hospital | Cleerly Series C

July 27, 2022

|

|

|

|

|

Together with

|

|

|

|

“If someone put me on the spot and asked why are we doing this, we’re doing this because it’s really good for patients. Oh, and by the way, it absolutely does help us on the cost front.”

|

|

Mass General EVP Dr. Gregg Meyer on the system’s hospital-at-home expansion.

|

|

|

|

Mass General Brigham is living up to its reputation as a healthcare innovator after laying out plans for a “massive expansion” of its hospital-at-home program to help contain costs and manage the ongoing capacity crunch at its facilities.

The health system intends to grow its current program from 25 patients to upward of 200 hospital-at-home beds by 2025, with 90 fully-operational beds expected before the end of next year.

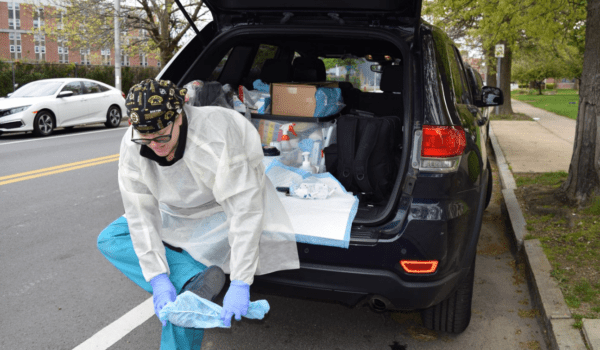

MGB’s hospital-at-home service provides hospital-level care at a patient’s residence, allowing those who are stable enough to be monitored remotely to recover from the comfort of their home. Patients have access to virtual meetings with their care teams, as well as in-person visits from physicians, nurses, and case managers.

- As part of the expansion, MGB appointed its first-ever president of home-based care, Heather O’Sullivan, who most recently worked for one of the country’s largest home care providers, Kindred at Home.

- Over the next year, O’Sullivan will oversee the hiring of 200 additional workers to bring MGB’s total home care staff to 1k employees, and will ramp up its fleet of remote care vehicles from 2 to 10 to enable more home testing and medical supply deliveries.

Dr. Gregg Meyer, EVP of value-based care for MGB, compared the hospital-at-home program to a house call from a doctor, which not only gives patients more convenience, but also lets providers observe SDOH factors that might impact recovery.

- MGB cited a 2019 study showing that its hospital-at-home service led to a 38% cost reduction compared to traditional care, while other programs have lowered readmissions and helped alleviate hospital capacity issues.

The Takeaway

Mass General Brigham ranks among the most highly visible health systems in the world, and all eyes are now on the results of its hospital-at-home expansion. If MGB can successfully create a more convenient recovery experience while simultaneously reducing costs, it could cause plenty of other organizations to replicate the model. That said, hearing a health system like MGB refer to 200 patients as a massive expansion also serves as a good reminder that scaling these types of programs is far from an easy task.

|

|

|

Empower Your Staff With connectRN

Learn how connectRN’s nurse-scheduling app can empower your shift managers and community leadership with a more predictable and sustainable approach to staffing, so they can focus on providing exceptional care.

|

|

Creating an Exceptional Engagement Experience

With a surge in experience‑oriented disruptors entering the healthcare industry, patient engagement is becoming a crucial competitive differentiator. Get your copy of Nuance’s guide to delivering intelligent interactions and a better experience at every touchpoint.

|

|

- Cleerly Series C: Heart attack prediction startup Cleerly closed a colossal $192M Series C round, quadrupling its Series B raise and catapulting its total funding to $249.5M. Cleerly plans to use the investment to expand the commercial reach of its AI software that evaluates noninvasive CT angiograms for plaque build-up to enable earlier detection of heart disease and calculate the likelihood of a patient having a heart attack.

- Haley Startup Map: Online mental health resource Haley gave us a great overview of the behavioral health startup landscape, which included quick business model summaries for over 30 companies. Haley clearly lays out the different approaches happening in the space, including mental health services (BetterHelp, Cerebral, SonderMind), mental wellness (Circles, Real, Ours), practice admin (Alma, Ease, Heard), and combo plays (Headspace, Lyra, Spring Health).

- Data Privacy Survey: An AMA survey of 1k adult patients found that 92% think their health data shouldn’t be able to be purchased by corporations, although 75% feel comfortable sharing the information with their physician. Many consumers have grown less comfortable sharing health data after the overturning of Roe v. Wade cast a spotlight on lackluster privacy protections, and respondents reported that they’re now most concerned about sharing health data with social media sites (71%), big tech (67%), and prospective employers (63%).

- Everside Raises $164M: Direct primary care provider Everside Health scored $164M in growth equity funding to scale its in-person and virtual services while it searches for potential M&A targets. Everside works directly with labor unions, school districts, and employers under a value-based model that reportedly lower healthcare costs by an average of 17% by Year 3. The company operates more than 375 health centers in 34 states and reaches over 600k patients, but it’s safe to assume that $164M will make those figures outdated fairly soon.

- Geisinger ProvenExperience: It probably would have been logical to expect expenses for hospital refund programs to skyrocket during the middle of a patient experience crisis like the pandemic, but Geisinger surprisingly found the opposite to be true. Geisinger’s ProvenExperience program has seen total refunds decline from $320k in 2016 to just $40k in 2021, which the health system’s CPEO Dr. Greg Burke attributes to a culture of accountability created by refunds being tied to action plans that prevent other patients from experiencing the same shortfalls.

- Home Care Preferences: A Cross Country Healthcare survey of 500 US residents between 50 and 79 years of age found that 70% would prefer to age at home rather than go to a retirement community or nursing home. Despite a growing preference for home care, only 9% said they’re actively looking into their future health needs, citing reasons such as not having any health issues (51%), purposely avoiding thinking about it (30%) or not being able to afford it (27%).

- 3M’s Healthcare Spin Out: After months of rumors that 3M was exploring options to offload its healthcare business, the company officially announced that it will spin out the unit as a standalone entity by the end of 2023. The new entity will include 3M’s wound care, dental, health-IT, biopharma filtration products ($8.61B in combined revenue last year), with the new structure designed to “make both companies well positioned to pursue their respective priorities.”

- Youth Mental Health Report: An interesting report from Telosity by Vinaj Ventures quantified the rapid rise in youth mental health startups, showing that investment in the segment climbed 15X between 2018 and 2021. Last year’s $871M in youth mental health funding was largely directed towards companies developing mobile applications, and one of the biggest takeaways from the report was that mobile apps account for 96% of all products developed by digital mental health startups due to GenZ’s preference for the modality.

- Summer Health: Summer Health secured $7.5M in seed funding to support the launch of its text-based concierge service for pediatric care. The company plans on becoming a “doctor in your pocket” through its $20/mo service that lets parents text real doctors questions about their child’s ailments and get responses in under 15 minutes.

- Childcare Stress Drives Burnout: Childcare stress (CCS) has devastated medical staff throughout the pandemic, according to a JAMA survey of 58k US healthcare employees. Researchers found those with high CCS were 80% more likely to feel burnt out, 115% more likely to have anxiety or depression, 91% more likely to intend to reduce work hours, and 28% more likely to plan to quit their job.

|

|

Streamlining Care With BrainInsight AI

Discover how Hyperfine’s BrainInsight AI tools are streamlining patient care by giving clinicians the quantitative biomarker information needed to reduce the burden of manual brain MRI measurements and decrease the time to diagnose and treat.

|

|

|

|

|